Analysis: How Long Should I Stake POLIS For?

Since the announcement of the POLIS DAO and staking a little more than a week ago, the debate surrounding POLIS staking has revealed several distinct thought strategies on the appropriate time frame for staking. As the beginning of the emission rewards approaches on August 2, POLIS holders must ask themselves — How long to stake POLIS for?

The purpose of this article is to better inform POLIS holders on some known facts and plausible assumptions ahead of making such a big decision. This article will analyze the pros and cons of short versus long term lock periods and some points to consider with each choice. Information contained within this article should not be construed as advocacy for a particular lock duration.

~~~~~~~~~

How long to stake POLIS for?

Before delving into some analysis, here are some understood facts about POLIS staking and emissions.

- Holders can choose one of any ten lock periods to stake POLIS, each with a different POLIS Voting Power multiplier (PVP*)

- Daily emissions for a given wallet is a calculation of the number of tokens staked time the Length of Stake Multiplier

- PVP, and thus an individual’s emissions, will decline linearly over time. To maintain the maximum emission rate, POLIS holders would need to extend their stake for the maximum duration daily.

- Daily emissions are calculated by comparing an individuals PVP and comparing that to the total communal locked PVP. The greater individual share of PVP the greater the emissions.

- Daily POLIS emission will follow a declining fixed curve over an eight year period — Daily total emissions will begin around 52,000 POLIS and steadily decline to 32,000 POLIS over that eight year period (Source — ATMTA CEO Michael Wagner).

- At time of writing, the current Total Locked Value of the POLIS Locker is 7.9 million Tokens.

- ATMTA will stake their tokens in three separate wallets for a duration of 3, 4, and 5 years each. Currently, ATMTA plans to stake only a portion of their tokens to avoid weighting the share of emissions in their favor while still retaining a controlling interest in the DAO.

* For an in-depth description of PVP please see our POLIS DAO article

~~~~~~~~~

Non-weighted daily emission formula

Using the facts about the POLIS locker, some inferences can now be made regarding emissions.

Using a very basic formula, the non-weighted daily emission of a single POLIS token can be calculated by taking the daily emissions cap and dividing by the total number of locked tokens.

Total Daily Emissions / TLV = Non Weighted POLIS token emission (52,000 POLIS / 7,900,000 POLIS = .00658)

In the above formula, .00658 represents the non-weighted daily emission of a single POLIS token (e.g. 1 staked POLIS token yields .00658 daily POLIS in this formula). Keep in mind, this number will likely decrease over time as more token holders stake their tokens and the fixed POLIS emissions curve begins to decline. ATMTA has always made clear that most POLIS rewards will be distributed at the beginning.

~~~~~~~~~

Assumptions

What now follows are some loose assumptions that can be made regarding what a POLIS holder can expect for daily emissions.

According to a recent community poll, out of 104 respondents, a majority of POLIS holders plan to, or already have, staked their POLIS for a period of greater than three years.

These holders will receive 6, 8, or 10 times the PVP compared to a 6 month staker with the same amount of POLIS tokens. It is important to remember that an individual’s emissions are determined by a weighted average of the communal PVP.

What we can assume is that a bulk of the daily POLIS emissions will go to holders who have longer stakes since their POLIS and PVP is weighted more favorably by the emissions calculator. Taking the .00658 figure from above, an individual can then make some assumptions regarding their true POLIS weighted daily emission rate.

For example, if a person has staked 5000 POLIS, they can expect a non-weighted baseline return of ~32 POLIS per day (This is not the final figure). By then factoring in their duration of stake, a person can roughly estimate their likely true daily return of ATLAS. If a person has a 5 year lock, then they will likely see returns above that non-weighted figure. If a person has a less than three year lock, or even a sub-1 year lock, expect that non-weighted daily return to decrease. While a daily return of 32 POLIS from 5,000 POLIS staked sounds fantastic, expect any number of POLIS emissions to drop over the next year as more POLIS is locked, thus dispersing the distributed POLIS. Should the POLIS Locker reach a 50% capacity of total circulating supply, 5,000 POLIS would yield around single-digit POLIS per day.

2 Weeks or 5 years — A tale of two perspectives

There are many pros and cons to the answers of “How long to stake POLIS?”, many of which can only be addressed at the individual level. In a broad sense, the two ends of the POLIS spectrum can be broken down into two distinct thought camps.

Short term (2 weeks — 1 year)

Ignoring nonparticipation in the POLIS locker, a short term lock clearly represents the least amount of possible emissions out of all the available options. Proponents of shorter locks argue that the volatility and rapid bull/bear cycles of the crypto market make a long term lock unappealing. Should the market enter a bull market within the next year, any opportunity to capitalize on locked POLIS would be lost.

Short term lockers also argue that the Star Atlas DAO is at least a year or more from any impactful proposals and that PVP for proposal voting can still be obtained at a later date. Lastly, short-term advocates point to overall low emission incentives as a reason for not staking longer.

Long term (3–5 years)

Long term stakers arguably have a greater conviction regarding the Star Atlas DAO for a number of reasons.

Many long term proponents argue that if a person truly believes in the long term vision of Star Atlas, then there is no other logical choice. Long term holders also receive more daily POLIS emissions compared to token holders with similar or greater amounts of POLIS who staked for a lesser period.

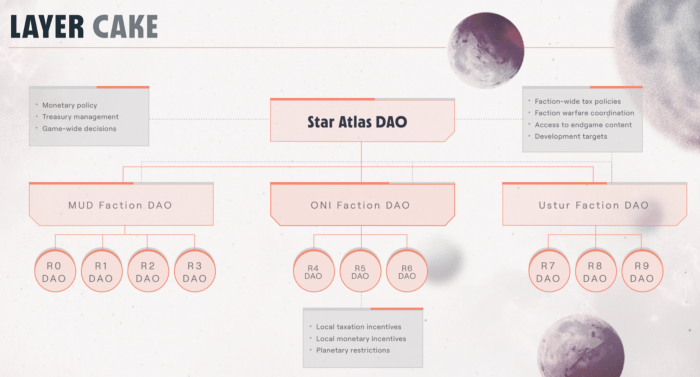

Long term staker are also likely seeking to maximize their PVP at every level of the Star Atlas DAO. That means capitalizing on every opportunity to acquire more POLIS. In the long run, having influence over the Star Atlas DAO may prove to be more beneficial that a short term monetary position.

Mid term (1–3 years)

As a middle ground, there is currently less vocal support for a blended option. POLIS holders appear to want to maximize their strategy at either end of the spectrum. However, a case can be made for a mixed approach. Beginning at 1 year, POLIS stakers do receive a 2x multiplier to their PVP up to 6x at 3 years.

If one believes both that a bull cycle is not likely in the next year, but wished to retain some level of liquidity in a time frame less than 5 years, the middle range of choices may be an attractive choice.

About the Author: Krigs

Star Atlas Discount

news via inbox

Get news from the Hologram first

[…] several days since the first reward period of the Star Atlas POLIS DAO and the initial data for POLIS staking APY is in. Since the first snapshot, roughly 4 million POLIS has been added to DAO […]